Annual Federal Gift Tax Exclusion 2025. For 2025, the annual gift exclusion increases to $18,000. For tax year 2025, it's $17,000.

Federal gift tax exemption 2025 for 2025, the annual gift tax limit is $18,000. The annual gift exclusion is applied to each donee.

These changes are a reflection of the evolving economic landscape and aim to ensure that taxpayers are aware of their obligations and entitlements.

How Smart Are You About the Annual and Lifetime Gift Tax Exclusions, The 2025 gift tax limit is $18,000, up from $17,000 in 2025. The annual gift tax exclusion for 2025 is the maximum amount of money or property that you can give to another person without having to pay federal gift tax.

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver, For 2025, the annual gift exclusion increases to $18,000. On the other hand, the annual gift.

Understanding The Annual And Lifetime Gift Tax Exclusion Limits How, There's no limit on the number. This means that you can give up to $18,000 to anyone without having to worry about paying any gift tax.

Gifting Time to Accelerate Plans? Evercore, Regarding annual gifts, the current (2025) federal annual gift tax exclusion is $17,000.00 per u.s. (that’s up $1,000 from last year’s limit since the gift tax is one of many tax amounts adjusted.

Gift Tax Limit 2025 Explanation, Exemptions, Calculation, How to Avoid It, The annual gift tax limit is $18,000 per person in 2025. The maximum credit allowed for adoptions for tax year.

What to Know About The 2025 Annual Gift Tax Exclusion, On the other hand, the annual gift. This means that you can give up to $18,000 to anyone without having to worry about paying any gift tax.

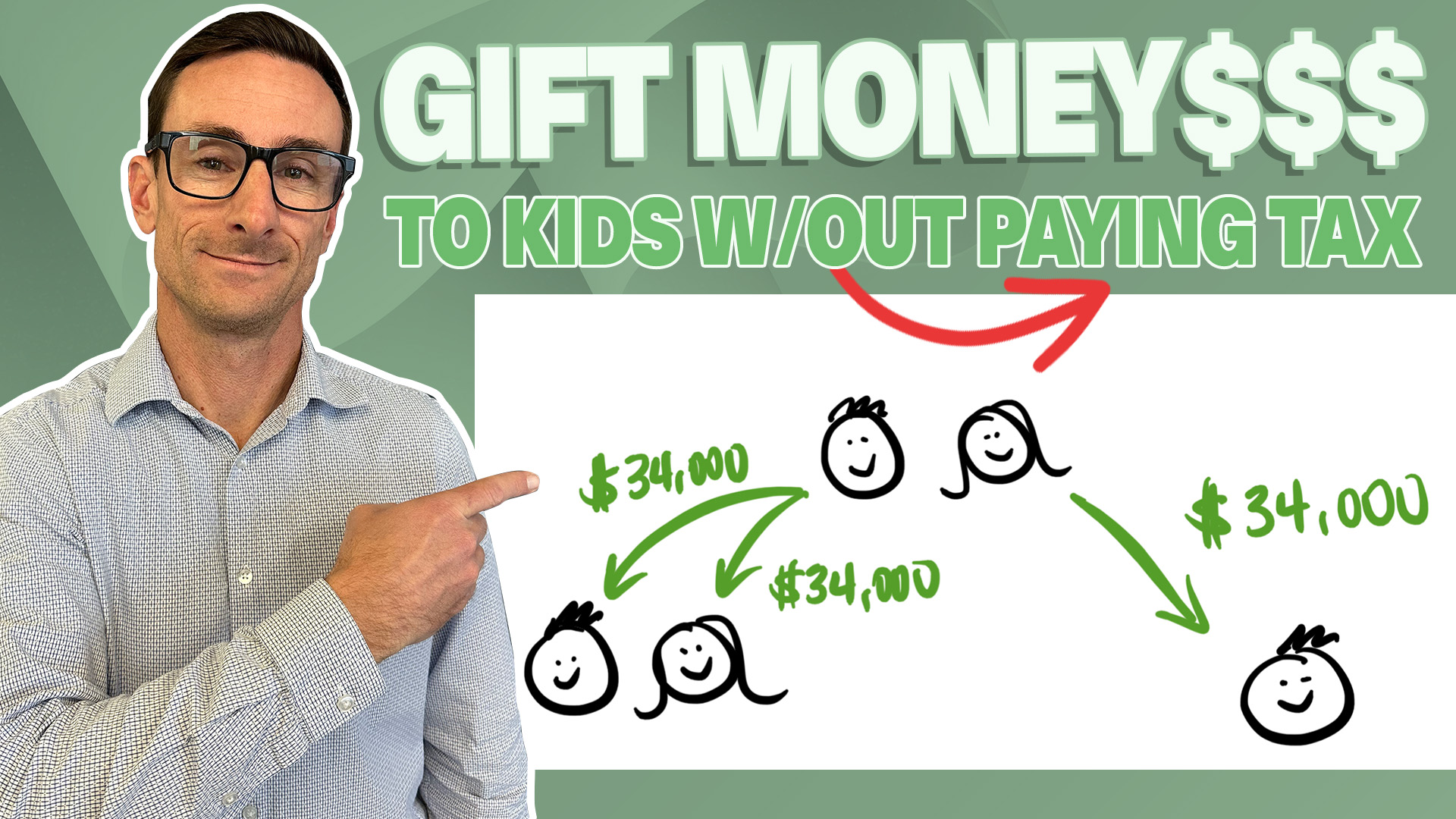

Gifting Money to Children Without Paying Tax (Annual Gift Tax Exclusion, The annual gift tax exclusion for 2025 is the maximum amount of money or property that you can give to another person without having to pay federal gift tax. Federal gift tax exemption 2025 for 2025, the annual gift tax limit is $18,000.

16,000 Annual Federal Gift Tax Exclusion How does it work? Serra, For 2025, the annual gift exclusion increases to $18,000. The annual gift tax exclusion for 2025 is the maximum amount of money or property that you can give to another person without having to pay federal gift tax.

Annual Gift Tax Exclusion 2025 Limits & Tips, For 2025, the annual gift tax exclusion is $18,000, meaning a person can give up to $18,000 to as many people as he or she wants without having to pay any taxes on the gifts. The annual gift tax limit is $18,000 per person in 2025.

Historic Increase to Your Lifetime Exclusion from Federal Estate Taxes, The annual gift exclusion is applied to each donee. Beginning on january 1, 2025, an individual may make gifts in an amount up to $18,000, in total, on an annual basis to any recipient without making a taxable gift, and married.

Beginning on january 1, 2025, an individual may make gifts in an amount up to $18,000, in total, on an annual basis to any recipient without making a taxable gift, and married.